The Rapaport Diamond Report 2023 provides a comprehensive price list for round brilliant cut diamonds‚ updated monthly‚ offering insights into market trends and pricing dynamics.

1.1 Overview of the Rapaport Diamond Report

The Rapaport Diamond Report 2023 provides a detailed price list for round brilliant cut diamonds‚ updated monthly‚ offering insights into market trends and pricing dynamics. It serves as a benchmark for pricing‚ covering carat weight‚ clarity‚ and cut specifications. The report also highlights the impact of supply and demand‚ synthetic diamonds‚ and De Beers’ influence on the market‚ making it a valuable resource for industry professionals.

1.2 Importance of the Report in the Diamond Industry

The Rapaport Diamond Report 2023 is a benchmark for diamond pricing‚ serving as a critical resource for wholesalers‚ retailers‚ and investors. It provides clarity on market trends‚ supply-demand dynamics‚ and the impact of synthetic diamonds. By offering detailed price indications‚ it aids in negotiations and inventory management‚ making it indispensable for industry professionals seeking accurate market insights and investment analysis.

Key Features of the Rapaport Diamond Report 2023

The report includes detailed price lists for round brilliant diamonds‚ carat weight specifications‚ and clarity grades‚ offering essential market data for industry professionals and traders.

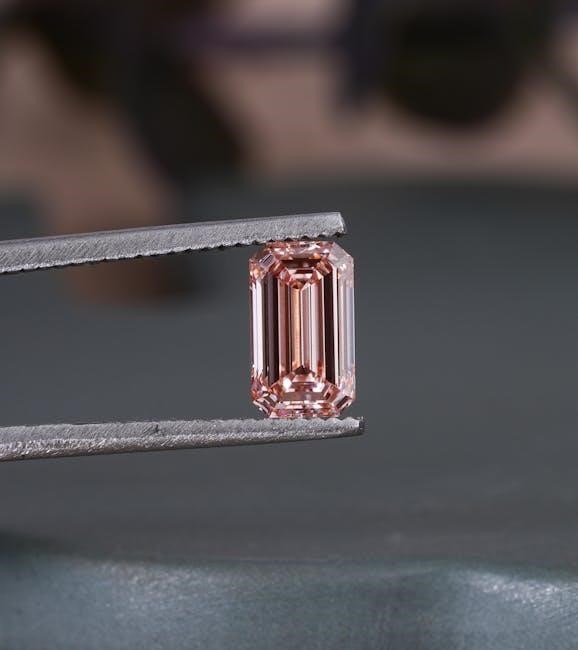

2.1 Price List for Round Brilliant Cut Diamonds

The Rapaport Diamond Report 2023 provides a detailed price list for round brilliant cut diamonds‚ categorized by carat weight and clarity grade. It covers a wide range of sizes‚ from 0.5 carats to 10 carats and above‚ and clarity grades from Flawless to I3. The list reflects high cash asking prices‚ offering a benchmark for market value and pricing negotiations in the diamond trade.

2;2 Carat Weight and Clarity Grade Specifications

The Rapaport Diamond Report 2023 details carat weight ranges from 0.5 to 10 carats and beyond‚ alongside clarity grades from Flawless to I3. Each specification is meticulously outlined‚ ensuring a standardized reference for evaluating diamond value. This detailed categorization aids industry professionals in accurately assessing and pricing diamonds based on their characteristics.

Market Trends and Insights from the 2023 Report

The 2023 report highlights declining diamond prices due to weakened retail demand and rising competition from synthetic diamonds‚ impacting market stability and investor confidence globally.

3.1 Diamond Price Fluctuations in 2023

Diamond prices experienced significant declines in 2023‚ driven by weakened retail demand and increased competition from synthetic diamonds. The Rapaport report noted a notable drop in polished diamond prices‚ particularly in larger carat sizes‚ as high inventories and reduced consumer spending exacerbated market challenges. Additionally‚ De Beers’ price reductions for rough diamonds further influenced the downward trend‚ creating uncertainty in the global diamond market.

3.2 Impact of Retail Sales and Synthetic Diamonds

Weak retail sales and rising competition from synthetic diamonds significantly impacted the 2023 diamond market. Synthetic diamonds offered affordable alternatives‚ reducing demand for natural stones. Retailers faced challenges as consumers favored lab-grown options‚ leading to price pressures. The Rapaport report highlighted this shift‚ noting that synthetic diamonds’ market presence influenced pricing strategies and profitability across the industry‚ reshaping traditional market dynamics.

Factors Influencing Diamond Prices in 2023

The 2023 diamond market saw supply and demand imbalances‚ De Beers’ price reductions‚ and synthetic diamond competition significantly impacting pricing dynamics and market stability globally.

4.1 Supply and Demand Dynamics

In 2023‚ supply and demand imbalances significantly influenced diamond prices. Weak retail demand‚ coupled with high polished inventories‚ led to downward price pressures. De Beers’ rough price reductions further impacted the market‚ while synthetic diamonds intensified competition. These dynamics created a challenging environment‚ altering pricing strategies and market stability‚ as the industry adapted to shifting consumer preferences and economic uncertainties.

De Beers’ price reductions in 2023 played a crucial role in shaping the diamond market. Their strategic adjustments to rough diamond prices aimed to stimulate demand and maintain market stability. These reductions influenced polished diamond pricing‚ as reflected in the Rapaport Report‚ highlighting De Beers’ significant impact on industry dynamics and pricing trends throughout the year. This move underscored their market leadership and adaptability. The Rapaport Diamond Report offers pricing guidance‚ market insights‚ and analysis‚ enabling professionals to make informed decisions‚ ensuring transparency and accuracy in diamond trading and investments globally. The Rapaport Diamond Report provides wholesalers with precise pricing guidance‚ ensuring accurate valuations. It reflects high cash asking prices for diamonds‚ helping professionals negotiate deals effectively. The report’s data enables wholesalers to align their pricing with market trends‚ maintaining profitability and competitiveness in the global diamond trade. This resource is indispensable for informed decision-making and fair pricing strategies. The Rapaport Diamond Report provides detailed market analysis‚ essential for investors assessing diamond value. It highlights trends like declining prices due to weak demand and synthetic competition. The report also covers De Beers’ price adjustments and their market impact. This data helps investors evaluate risks and opportunities‚ guiding informed decisions in the diamond investment sector. De Beers’ 5-15% price reduction on rough diamonds significantly influenced market dynamics‚ impacting polished prices and inventory levels amid weakened demand and synthetic competition in 2023. De Beers reported a 34% decline in sales compared to 2022‚ totaling $3.8 billion‚ as per the Rapaport Diamond Report. This reduction was attributed to weakened global demand and increased competition from synthetic diamonds. The company also implemented price reductions of 5-15% on rough diamonds to stimulate market activity and align with changing consumer preferences and market pressures. De Beers implemented a 5-15% reduction in rough diamond prices to address market challenges. This move aimed to stimulate demand and align with weaker retail sales. The price cuts contributed to a decline in polished diamond prices‚ with inventories remaining high amid slow consumer demand and growing competition from synthetic diamonds‚ further pressuring the natural diamond market. Synthetic diamonds are increasing in acceptance‚ creating competition for natural diamonds and impacting pricing dynamics‚ as highlighted in the Rapaport Diamond Report 2023. Lab-grown diamonds are increasingly competing with natural diamonds‚ offering similar quality at lower prices. This shift is altering market dynamics‚ as consumers opt for cost-effective‚ ethically produced alternatives‚ impacting natural diamond pricing and demand‚ as noted in the Rapaport Diamond Report 2023. Natural diamonds face pricing challenges due to competition from lab-grown alternatives and shifting consumer preferences. The Rapaport Diamond Report 2023 highlights declining prices in 2023‚ driven by weak retail sales and synthetic diamond competition. High polished inventories and discounted pricing further exacerbate market pressures‚ impacting profitability for natural diamond producers and retailers. The Rapaport Diamond Report 2023 assesses the investment potential of high-value diamonds as stable assets despite market risks and price volatility in 2023. The Rapaport Diamond Report 2023 highlights high-value diamonds as stable investment assets‚ emphasizing their potential for appreciation. These diamonds‚ often sought for their rarity and quality‚ attract luxury consumers and investors. The report evaluates their performance‚ noting competitive premiums in speculative markets. High-value diamonds remain a popular choice for those seeking tangible assets with long-term value potential‚ despite market volatility. Investors face risks like market volatility‚ liquidity challenges‚ and potential price fluctuations. High inventories and weak retail demand‚ coupled with synthetic diamond competition‚ may impact returns. The Rapaport Report highlights that off-make diamonds and poorly cut stones are illiquid‚ making them difficult to sell. Additionally‚ economic downturns and shifting consumer preferences pose risks‚ requiring careful analysis before investing in diamonds. The Rapaport Diamond Report provides insights into diamond pricing‚ helping wholesalers and retailers understand market trends‚ negotiate effectively‚ and make informed purchasing decisions accurately. The Rapaport Diamond Report 2023 provides approximate high cash asking price indications for round brilliant cut diamonds‚ reflecting market trends and pricing dynamics. These prices‚ often discounted‚ serve as benchmarks for wholesalers and retailers to negotiate and make informed decisions. Understanding these indications helps professionals assess value‚ track fluctuations‚ and align pricing strategies with current market conditions effectively. The Rapaport Diamond Report 2023 offers practical tools for buyers and sellers to negotiate fairly‚ set competitive prices‚ and make informed decisions. Buyers can assess market value‚ while sellers can benchmark pricing. The report aids in inventory valuation and helps track price trends‚ enabling both parties to align strategies with current market dynamics and optimize transactions effectively. The Rapaport Diamond Report 2023 concludes with insights into market dynamics‚ highlighting challenges and opportunities. It predicts a competitive landscape in 2024‚ driven by synthetic diamonds and evolving consumer preferences. The Rapaport Diamond Report 2023 highlights significant price trends‚ with fluctuations influenced by supply-demand dynamics‚ synthetic diamond competition‚ and shifting consumer preferences. De Beers’ pricing strategies and market adjustments were pivotal‚ impacting the global diamond trade. The report underscores the growing importance of transparency and sustainability in the industry‚ while also noting challenges in maintaining price stability amid economic uncertainties. The 2024 diamond market is expected to see continued competition from synthetic diamonds‚ influencing natural diamond pricing strategies. De Beers may stabilize rough diamond prices to support market balance. Selective demand for high-value diamonds could persist‚ driven by investment interest. The industry may focus on transparency and sustainability to differentiate natural diamonds‚ while navigating evolving consumer preferences and economic conditions.4.2 Role of De Beers and Rough Diamond Prices

Benefits of the Rapaport Diamond Report for Industry Professionals

5.1 Wholesale Pricing Guidance

5.2 Investment and Market Analysis

The Role of De Beers in the 2023 Diamond Market

6.1 De Beers Sales Performance in 2023

6.2 Price Reductions and Market Impact

The Impact of Synthetic Diamonds on the Market

7.1 Competition from Lab-Grown Diamonds

7.2 Pricing Challenges for Natural Diamonds

Investment Potential of Diamonds in 2023

8.1 High-Value Diamonds as Investment Assets

8.2 Risks and Considerations for Investors

How to Use the Rapaport Diamond Report Effectively

9.1 Understanding Price Indications

9.2 Practical Applications for Buyers and Sellers

10.1 Summary of Key Findings

10.2 Predictions for the Diamond Market in 2024